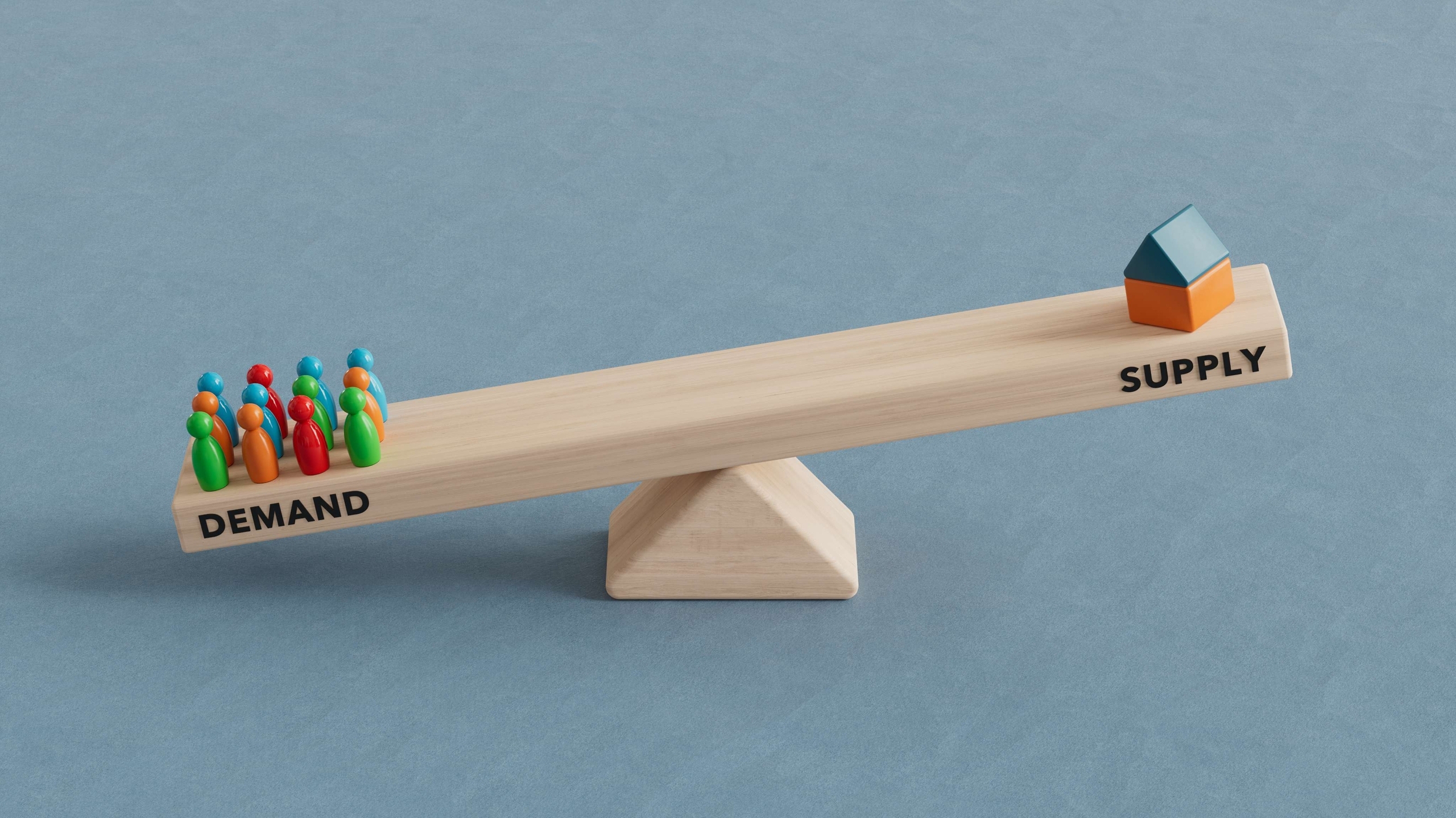

As 2024 comes to an end, the U.S. housing market continues to struggle with two major problems: not enough homes for sale and high mortgage interest rates. After a year full of uncertainty, real estate experts are looking ahead to 2025, expecting another year of tough competition and limited options.

Low Supply Continues to Be a Problem

In 2024, homebuyers across the country faced a market with very few homes for sale. Sellers are staying out of the market, and builders are facing challenges like labor shortages, supply chain delays, and high material costs.

This issue is caused by a few key factors: homeowners with very low mortgage rates are reluctant to sell their homes and trade to a higher rate; Meanwhile, new homes aren’t being built fast enough to keep up with demand.

This problem exists everywhere, from the Midwest to the coasts.

High Mortgage Rates Add to the Challenge

High mortgage interest rates are another major hurdle heading into 2025. Just a few years ago buyers enjoyed historically low rates, but now higher rates, coupled with higher home prices, make monthly payments harder to afford.

Buyers are left with tough choices. Some are turning to adjustable-rate mortgages or other financing options. Others are expanding their search to less popular areas or waiting until conditions improve. Unfortunately, these challenges won’t improve much until interest rates stabilize or decrease.

No Area Is Spared

This housing crisis affects every region. In the past, buyers could move from expensive coastal cities to more affordable areas inland. Now, even smaller cities and towns face high demand and low supply. From the Sunbelt to quiet rural areas, finding a home has become harder than ever.

Possible Solutions for 2025

As the new year approaches, policymakers and industry leaders are exploring ways to help. Local governments are considering changes to zoning laws to allow for more housing, while some states are offering incentives for homeowners to sell.

On the national level, the Federal Reserve’s interest rate decisions and potential programs for first-time buyers could bring relief. However, these changes take time, and it’s unclear how effective they will be.

Looking Ahead

The challenges of 2024 aren’t going away. Instead, the end of the year is a time to rethink strategies, whether you’re a buyer, seller, or policymaker. Buyers must stay flexible and creative in 2025, working with experienced real estate agents to navigate the tough market. Sellers will find they can get strong offers due to limited competition—if they’re willing to sell.

While the future remains uncertain, one thing is clear: the housing market will continue to grapple with low inventory, high rates, and tough decisions for everyone involved. Understanding these challenges and planning will be key to navigating the year ahead.