Key Take-Aways:

- As the Fed’s rhetoric softens around continuing to increase rates and the fluctuation in mortgage rates settle, buyers appear to be gaining confidence.

- After a downward trend over the previous 6 months, prices have been steadily rising since. In March, average sales price increased 4.5% month-over-month, and increased 1.3% month-over-month in April.

- Inventory remains limited, which appears to be the primary driver increasing prices.

- Sale/List price ratio saw a sizable increase, with sellers averaging 1.35% over their asking price across the 459 closings that we had last month.

- ~70% of sales closed at or above asking price. 1/3 sellers received 5%, or more, over their asking price, while 1/10 sellers received 10% or more over their asking price.

- In conclusion, we are still very much in a sellers market and this will not change unless there is a dramatic shift in the landscape.

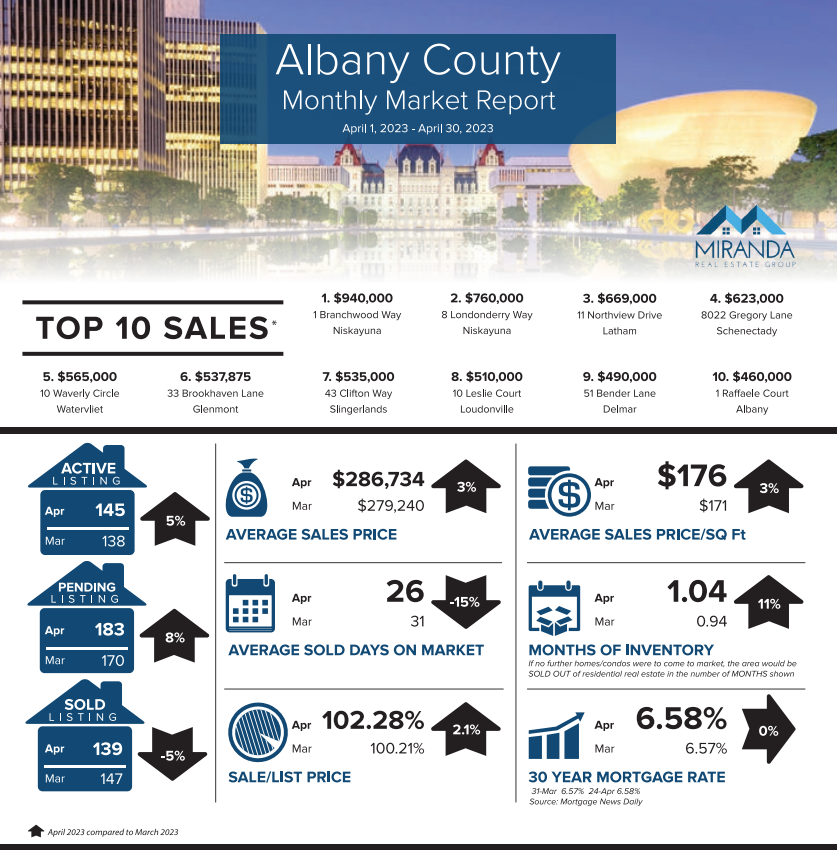

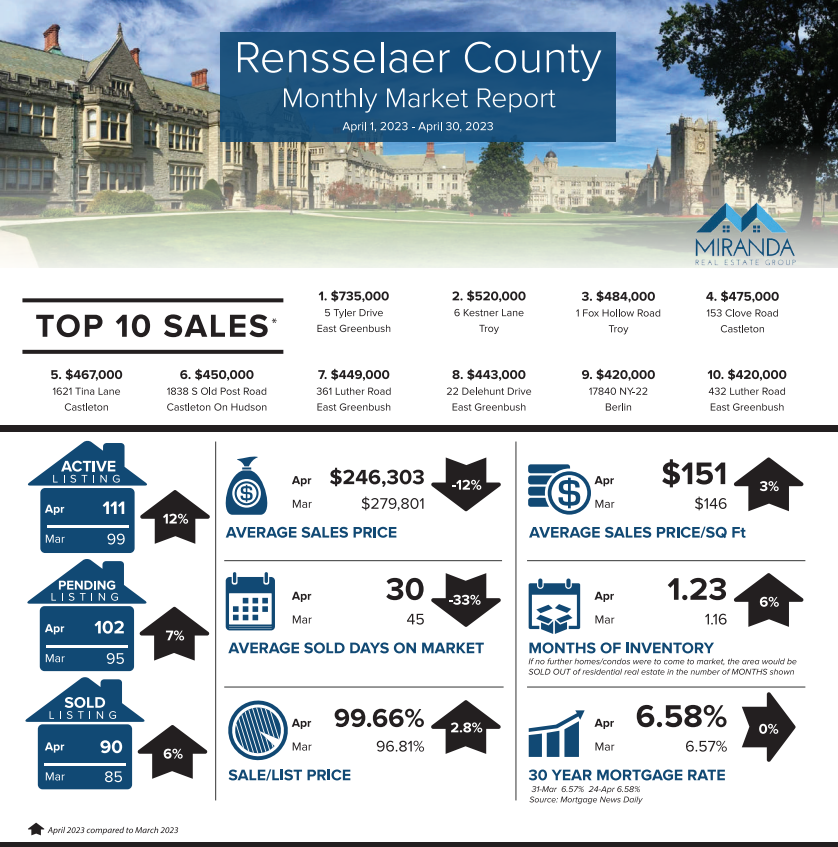

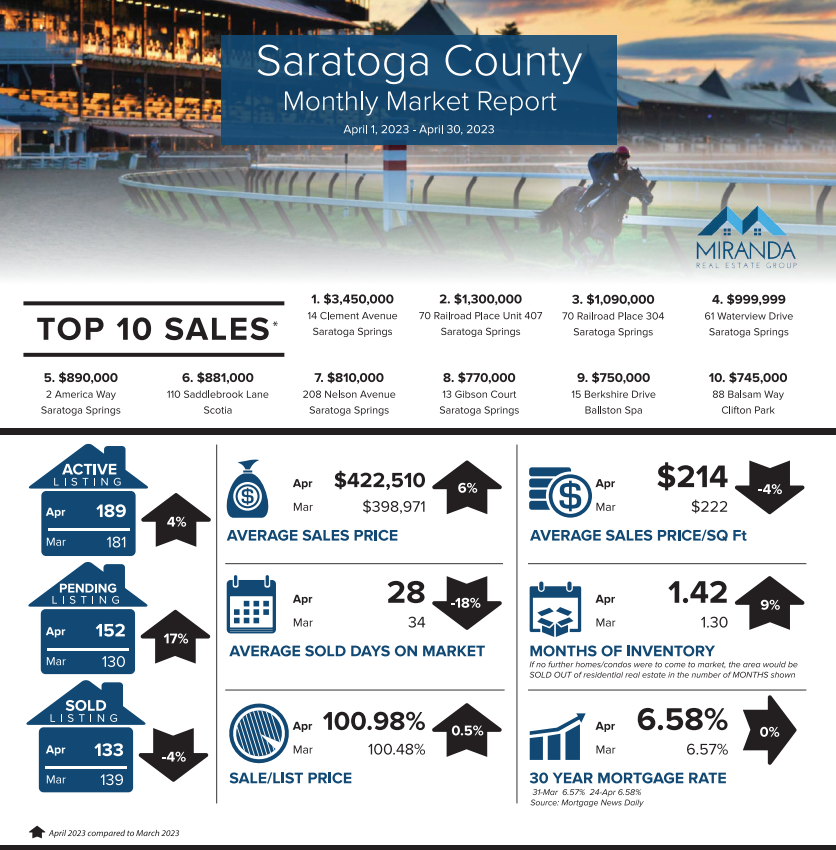

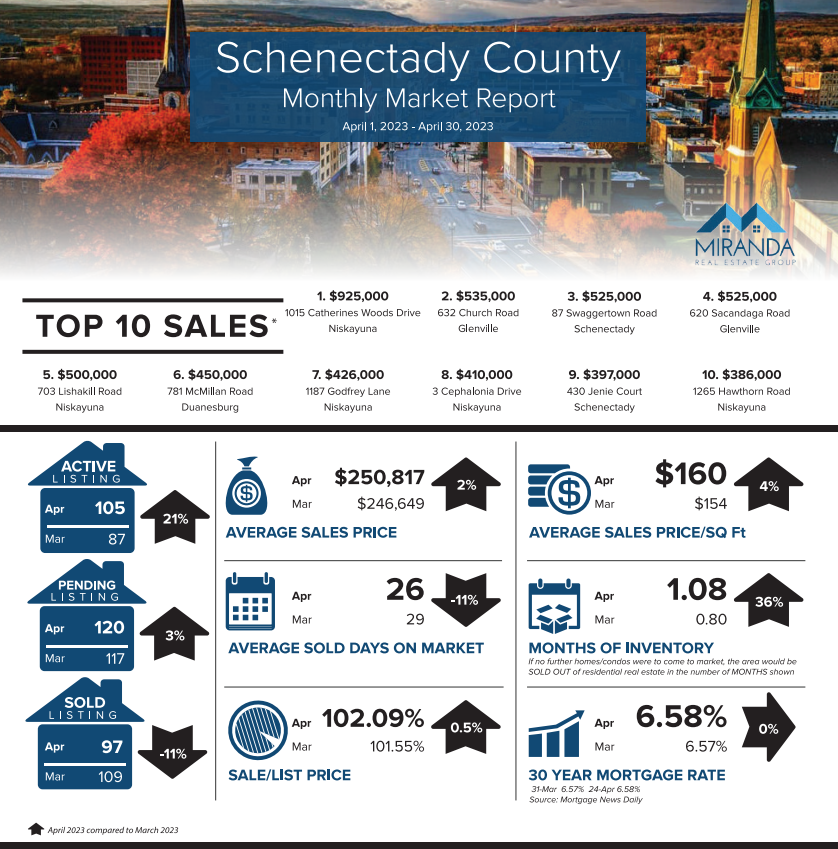

According to data from the Global MLS, the marketplace for NY Capital District residential properties, here are the latest stats:

-The Number of SOLD listings decreased by 4% to 459 properties with a top sale of $3.45 million at 14 Clement Ave in Saratoga Springs.

-The Average Sales Price increased 1.3%, to $310,559, while the Average Price Per Square Foot stayed relatively flat at $179/sq. ft.

-The inventory of properties available for sale as measured in months supply increased to 1.2 months’ worth of properties for sale.

-The average 30-year fixed mortgage rate increased slightly to 6.58% according to Mortgage News Daily.

–Sellers are receiving higher offers, netting an average of 1.35% over their asking price.

In summary, our market is showing the typical signs of a Spring market–more homes are coming available for sale, and prices are increasing. With the combination of mortgage rates settling, Fed rhetoric cooling on continuing to increase rates, and scant inventory levels our market will continue to be very competitive in the short to medium term.