Key Take-Aways:

- Prices up 8% to an average of $383,978. A new 12-month high.

- Interest rates increased from the high-6% range to mid-7%

- Inventory remains challenging dropping slightly when compared to Q3 ’22 close

- Inventory levels of a 4 – 6 months’ supply is considered balanced, so there is still a long way to go.

- Sale/List price ratio saw a sizable increase, with sellers averaging 3.71% compared to an average of 2.66% last year

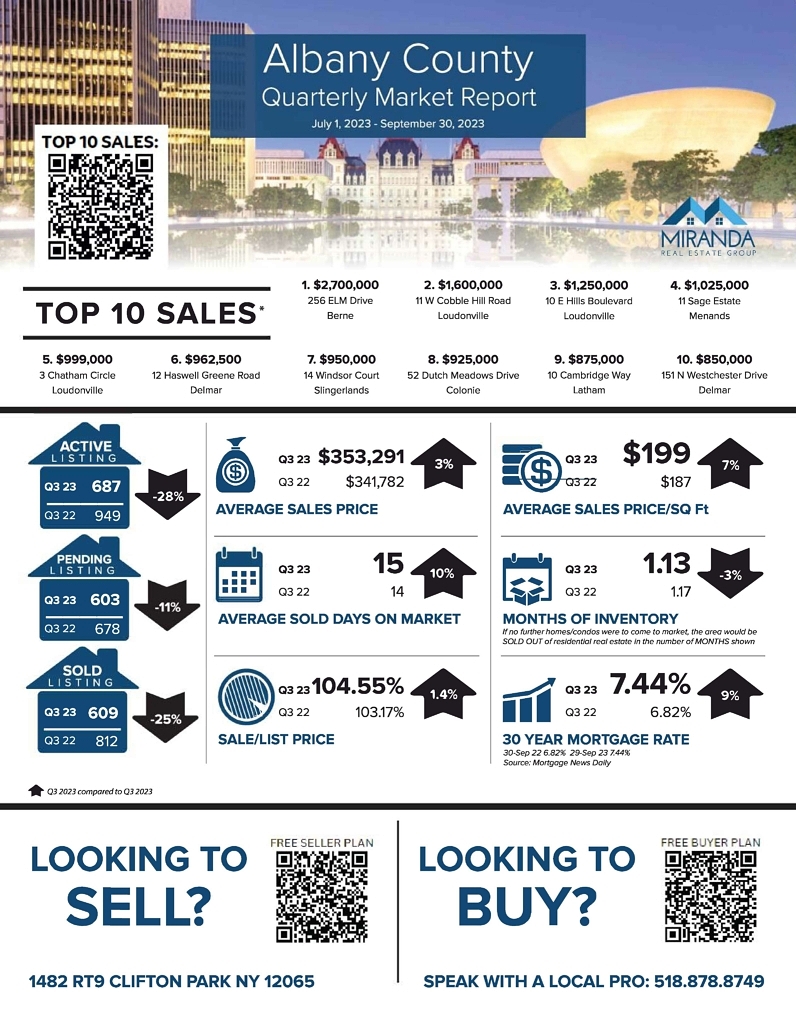

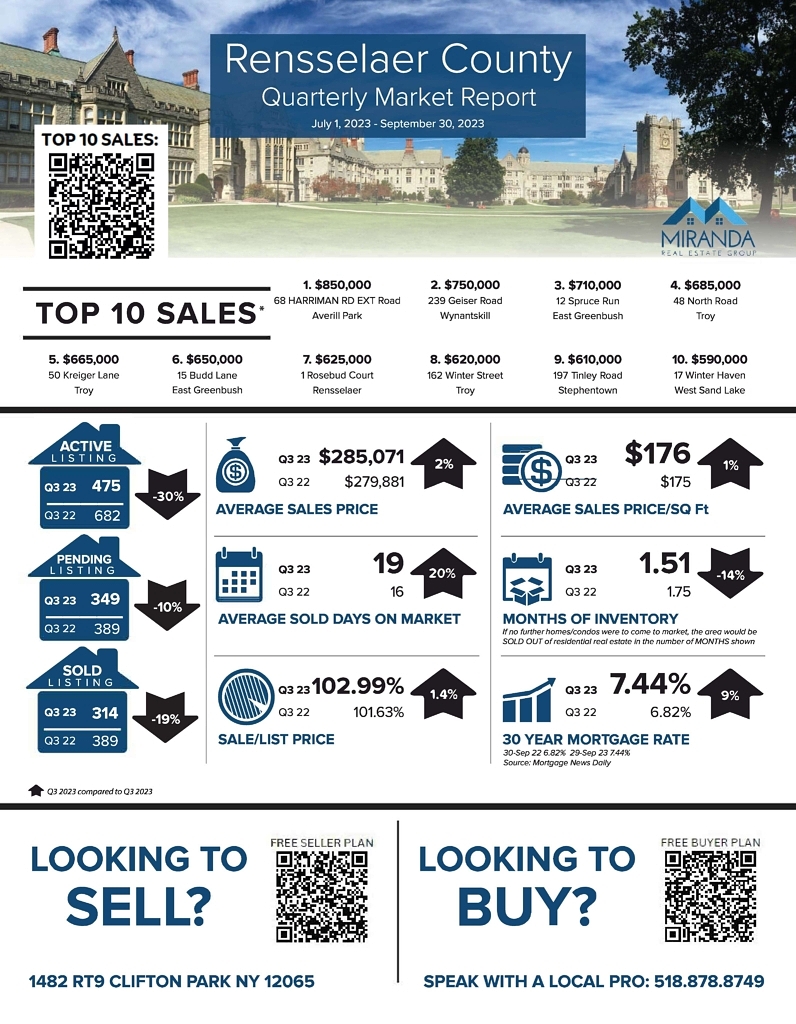

According to data from the Global MLS, the marketplace for NY Capital District residential properties, here are the latest stats:

-The Number of SOLD listings decreased by 19% to 1,995 properties with a top sale of $7.137 million at 637 North Broadway, AKA the “Pallazzo Riggi” in Saratoga Springs.

-The Average Sales Price increased 8%, to $354,158.

–Average Price Per Square Foot increased 6% to $197/sq. ft.

-The inventory of properties available for sale as measured in months supply decreased to 1.25 months’ worth of properties for sale

– According to Mortgage News Daily, the average 30-year fixed mortgage rate increased to 7.44%

–Sellers are continuing to receive offers over asking, netting an average of 3.71% over their asking price, an increase of 1.05% over the Q3 2022

In summary, even in the face of increasing interest rates, the short housing supply continues to drive the average sales price upward. There is little sign of the market cooling based on the current supply and demand trend we are experiencing in our market.