Key Take-Aways:

- Average sales price has appeared to level out, hovering around $365,000 over the last 3 months

- Inventory levels are still low and bidding wars continue to challenge buyers

- Sale/List price ratio held relatively flat, with sellers averaging 3.48% over their asking price

According to data from the Global MLS, the marketplace for NY Capital District residential properties, here are the latest stats:

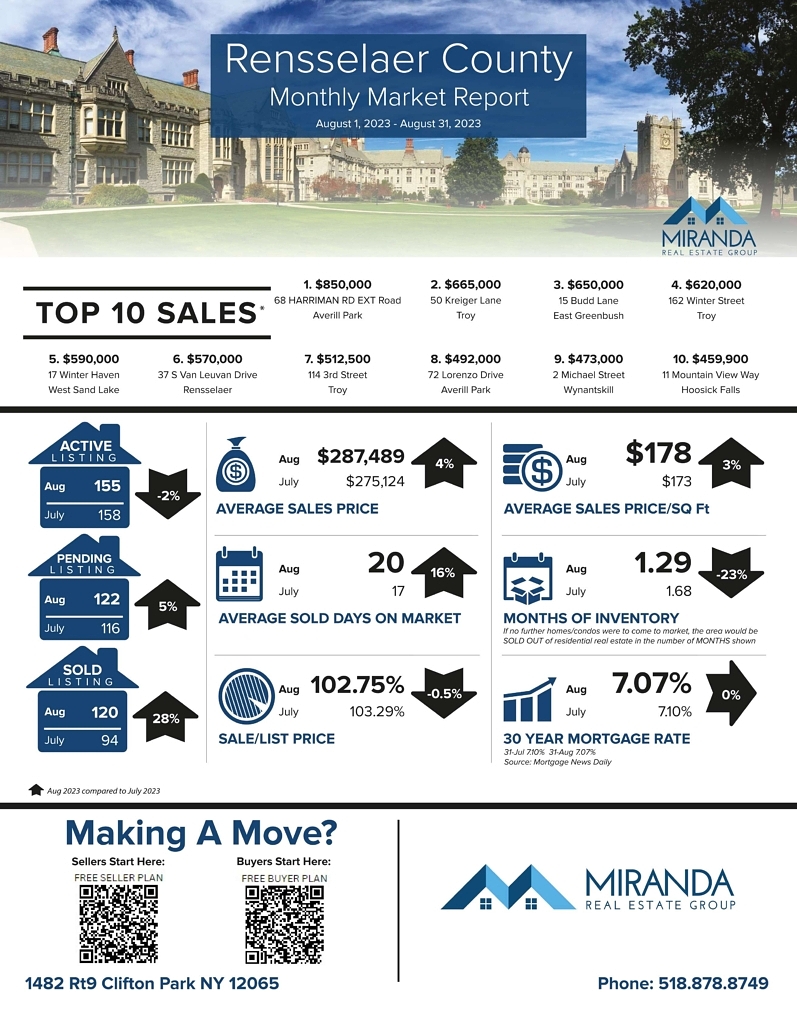

-The Number of SOLD listings increased by 28% to 765 closed properties with a top sale of $1.9 million at 36 Hyde St in Saratoga Springs.

-The Average Sales Price remained flat, ending at $365,625.

–Average Price Per Square Foot increased by 1%, ending at $201/sq. ft.

-The inventory of properties available for sale as measured in months’ supply decreased to 1.08 months’ worth of properties for sale.

– Mortgage News Daily shows that the average 30-year fixed mortgage rate decreased slightly to 7.07%.

–Sellers are receiving higher offers, netting an average of 3.48% over their asking price, a decrease from the 4.17% premium received the previous month

In conclusion:

We are still very much in a seller’s market. Despite the downward pressure that increased interest rates are having on prices, the low inventory levels continue to buoy prices by overwhelming the drag that 7+% interest rates should be having on price levels.

Would-be sellers are reluctant to trade the 3-4% interest rates they are currently enjoying, even if they are looking to upgrade or downsize.

Downsizing but having the same (or an even higher) monthly payment is a bitter pill to swallow while upgrading comes with a significant price tag.